Nvidia takes Microsoft’s crown as most valuable company

Traders work on the floor of the New York Stock Exchange during morning trading on Feb. 14, 2024.

Michael M. Santiago | Getty Images

This report is from today’s CNBC Daily Open, our international markets newsletter. CNBC Daily Open brings investors up to speed on everything they need to know, no matter where they are. Like what you see? You can subscribe here.

What you need to know today

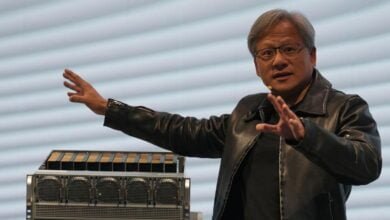

Nvidia takes the crown

Nvidia on Tuesday surpassed Microsoft to become the world’s most valuable public company with a market cap of $3.34 trillion. The milestone comes after a remarkable 170% surge in its share price this year, and a more than nine-fold increase since the end of 2022 fueled by the boom in generative artificial intelligence. Nvidia has an 80% share of data center AI chip market as Microsoft, Apple, Alphabet and Amazon snap up processors needed to power AI models.

Another record high

The S&P 500 inched its way to another record high as Nvidia dethroned Microsoft as the world’s most valuable company. The Nasdaq Composite just about ended the day in positive territory. The Dow Jones Industrial Average inched up 56 points. May retail sales raised concerns about the world’s biggest economy, while U.S. oil prices rose for the second day. The yield on the 10-year Treasury fell.

Under fire

Boeing CEO Dave Calhoun faced intense criticism from a Senate panel over the company’s safety issues, whistleblower complaints, and his compensation. Senator Josh Hawley accused Calhoun and Boeing of “strip mining” the company by cutting corners and criticized his $33 million compensation package. “Frankly sir, I think it’s a travesty that you are still in a job,” Hawley said. Calhoun defended Boeing’s efforts to improve manufacturing quality and safety, following a recent incident involving a midair door panel blowout.

Tepid sales growth

U.S. retail spending grew by a meager 0.1% in May, falling short of expectations. Sluggish growth, coupled with a downward revision for April’s figures, signals a slowdown in consumer spending. With spending accounting for two-thirds of economic activity, investors are hoping any weakness could prompt the Federal Reserve to lower interest rates to stimulate growth. Markets are pricing in at least two rate cuts this year, while Fed officials have indicated only one rate cut is likely.

Buffett oil

Warren Buffett‘s Berkshire Hathaway has steadily increased its stake in Occidental Petroleum. From June 5 to June 17, the conglomerate bought 7.3 million shares for under $60 each, filings show. It now owns over 255 million shares, representing a 28.8% stake in Occidental, making it the largest institutional investor. Berkshire also holds preferred stock and warrants in the oil company, with a potential future ownership exceeding 40%. Buffett has stated he has no plans to take full control despite receiving regulatory approval to purchase up to a 50% stake in the oil company.

[PRO] Nvidia rebalancing

Friday’s S&P 500 rebalancing, typically overlooked, is drawing significant attention due to Nvidia’s meteoric rise. The shift presents challenges for tech-focused ETFs and could affect their holdings of heavyweights like Nvidia, Microsoft, and Apple. Here’s what this means for investors.

The bottom line

The Federal Reserve has signaled one possible rate cut by the end of the year, while investors expect two cuts, according to the CME’s Fed watch tool.

Investors are grasping at any data that shows weakness in the economy that may prompt the Fed to cut again. The latest retail data showed consumer spending, which accounts for about two-thirds of economic activity, barely rose in May. Take out autos and it actually fell.

Paul Ashworth, chief North America economist at Capital Economics, noted in a message to investors, “Maybe households aren’t quite as impervious to higher interest rates as we were beginning to believe. Admittedly, we don’t expect a full-blown slump in consumption, but even a modest slowdown in consumption growth could be enough to tip a finely balanced Fed in favor of a rate cut in September.”

Boston Federal Reserve President Susan Collins expressed cautious optimism about recent inflation data.

“It is too soon to determine whether inflation is durably on a path back to the 2% target. Uncertainty remains high, and the volatility of monthly data remains elevated, including for inflation,” Collins remarked in Lawrence, Massachusetts. “We should not overreact to a month or two of promising news, just as it was not appropriate to take too much signal from the disappointing data at the beginning of this year.”

Federal Reserve Governor Adriana Kugler signaled the likelihood of a rate cut later this year.

“If the economy evolves as I am expecting, it will likely become appropriate to begin easing policy sometime later this year,” Kugler said at the Peterson Institute for International Economics in Washington.

Waiting too long to cut interest rates could stall the economy as consumers tighten their belts. As CNBC’s Jeff Cox writes, the Fed risks tipping the economy into contraction by not cutting rates now. Cox cites economist Claudia Sahm, who formulated a time-tested rule that indicates the likelihood of a recession.

Wall Street is acutely aware of this risk. While the S&P 500 reached another record high, its gains have been marginal in recent sessions. Tuesday’s high coincided with Nvidia taking the top spot as the most valuable company. Nvidia’s rapid ascent may continue as tech-heavy ETFs buy billions of dollars of stock to rebalance their portfolios.

— CNBC’s Jeff Cox, Kif Leswing, Bob Pisani, Leslie Josephs, Alex Harring, Samantha Subin, Spencer Kimball and Yun Li contributed to this report.

Source link