G. Willi-Food International Is On Sale (NASDAQ:WILC)

tbralnina/iStock via Getty Images

Opportunity

War is casting a shadow on the stock of G. Willi-Food International Ltd (NASDAQ:WILC). But war also presents opportunities for investors. We are maintaining our earlier Buy assessment and considering replenishing our holdings on dips to around $9 per share or less.

The share price is down 7.38% YTD as the fighting in Gaza drags on and the war on the northern front heats up. However, the share price is up ~14% to $9.47 since the October 7, ’23 Black Sabbath low of $8.12 per share. The price rebounded to ~$11.34 per share in January ’24. It is difficult to compare a relatively small company selling into a market with a population of 9M to public U. S. companies; however, the 12.26 P/E ratio of Willi-Food makes the stock a good value compared to the current average P/E of ~26x among food wholesalers.

Willi-Food imports kosher foods to Israel and the West Bank from +150 suppliers. The company markets and sells fresh and packaged goods through retail supermarkets, neighborhood groceries, and distributors. Zwi and Joseph Williger and their investment companies own controlling interests. The downside is that we perceive Willi-Food as a family-run versus a professionally-run business caring first and foremost for shareholders. Insiders own 72.74% of the shares. There is little public information or regular business updates from management. More transparency can be attractive to investors but shareholders have not been devalued.

The upside is the key people running the company seem unbound by committees and heavy-handed outsiders; decision-making adjustments in light of swiftly changing conditions also take less time. In our opinion, this is a major upside for shareholders, i.e., avoid giving short shrift to management’s ability to adjust to conditions and produce profits.

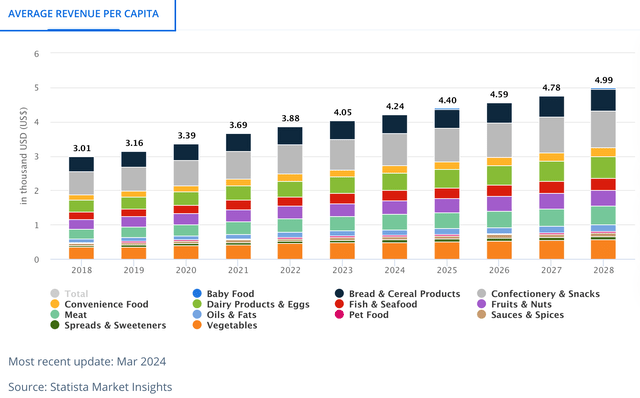

Statista Market Insights forecasts a continuous rise in the average revenue spending on foodstuffs among Israelis including most of the types of Willi-Food imports:

Average Revenue Spending By Israeli Food Consumers (Statista)

The Q1 ’24 financials reported in May ’24 were dour showing the impact of the Swords of Iron War on company sales and costs. The company reported a 9% increase in FY ’23 revenue marking record sales. The war’s impact hit hard. Goods from the Far East were delayed by military attacks on ships, container shortages, and rising prices for transportation lowered operating profits. Export embargos on goods to Israel from major agricultural and packaged food supply countries, especially Turkey, Israel’s third largest foreign supplier, hurt inventories and contributed to food inflation.

Finances and Valuation

According to Willi-Food, in the first quarter of FY ’24 ending March 31:

• Sales decreased by 10.1% to NIS 136.0 million (USD 37.0 million) from NIS 151.4 million (USD 41.1 million) in the first quarter of 2023.

• Gross profit decreased by 13.5% year-over-year to NIS 34.7 million (USD 9.4 million).

• Operating profit decreased by 10.7% year-over-year to NIS 11.6 million (USD 3.2 million).

• Basic earnings per share of NIS 1.34 (USD 0.36).

• Cash and securities balance of NIS 244.4 million (USD 66.4 million) as of March 31, 2024.

Management moved fast making changes in Q1 to threatening events. The cost of sales was cut by 10% compared to Q1 ’23. Operating expenses dropped from $7.33M Y/Y to $6.25M. Total financial income popped in Q1 ’24 to $3.1M from $1.43K at the end of Q1 ’23. Basic/diluted EPS was $0.36 in Q1 ’24 versus $0.21 in ’23.

$5M in profit from continuing operations was reported at the end of the first quarter of 2024 up from $2.94M in the first quarter of 2023. Cash and equivalents increased slightly to $36.6M compared to $35.7M the year before. The company spent ~$1.85M in ’23 and ’24 for property and construction of a new distribution facility. It will expand the company’s inventory capabilities and reduce distribution costs in 2025. Management has not offered updates on the facility’s progress so we cannot be sure when financial impacts will kick in.

In December ’22, the company boasted a market cap of ~$150M. The stocks moved around $16 per share. Annual revenue was $141.7M with a GP of 40.7%. In June ’24, the market cap stands at $130.77M with a GP running TTM at 31.2%. Management did not give any positive guidance for FY ’24 in their announcement at the end of March dampening but not extinguishing our enthusiasm. The current P/E of 12.26 times last year’s EPS of $0.63 suggests a fair value share price of $7.72. 12.26 times $0.77 (TTM) per Seeking Alpha equals a fair value price of $9.44.

Two other upsides to consider is that in 2023, the company announced its intent to buy back 5M shares. Another is that one individual bought 12.7K shares in the last three to six months.

Dividend

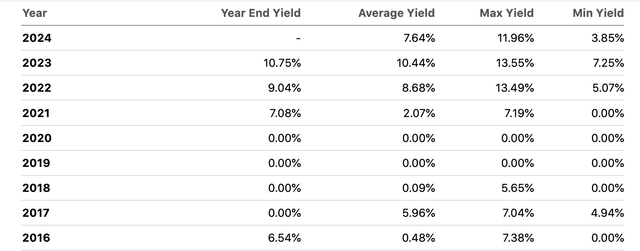

The current dividend yield is 4.12%. Its 4-year average is 5.91% compared to a consumer staples sector median of 2.4%. By earnings yield, Willi-Food beats the sector median. By operating earnings yield, the company (TTM) is at 3.9% versus 8.32%; we attribute this to the first quarter results.

The dividend is well-covered by free cash flow (TTM). Willi-Food has not had a long history of dividend payouts and consistent yields. We forecast that management will continue the current dividend payout rate throughout this year. The payout ratio is a mere 63%.

Yearly Dividend Rates (Seeking Alpha)

Risks

Investors must consider escalating risks that can drive down the share price.

- The foremost risk is the outbreak of a wider war in the Middle East that will further disrupt shipping and foreign investment.

- Inflation in Israel food prices persists in the 3% range. Consumers are discriminating about food purchases concentrating on essentials, but if people do not eat today they eat tomorrow. We do not envision much of a further drop in sales.

- Government policies, high taxes, and extrinsic business interruptions are having an egregious effect on the share price of G. Willi-Food.

- Management did not mention the status of the stock buyback in their first-quarter statement. There was no guidance from management on revenue and earnings growth in the last two quarterly reports. This lack of transparency and inadequate flow of information stymies investment.

- Though revenue grew in 2023, the gross profit and earnings dropped; the slippage gained momentum in Q1 ’24. The EPS growth rate is currently -5.7%.

Takeaway

Three years ago, the stock touched $25 per share. In our opinion, the share price will remain in the $9 to $10 range while tensions remain elevated. It can climb to its 52-week high of $13 per share if the war subsides sooner than expected, quiet returns to the north, reservists return home to normal life, and boycotts and transport costs are fixed.

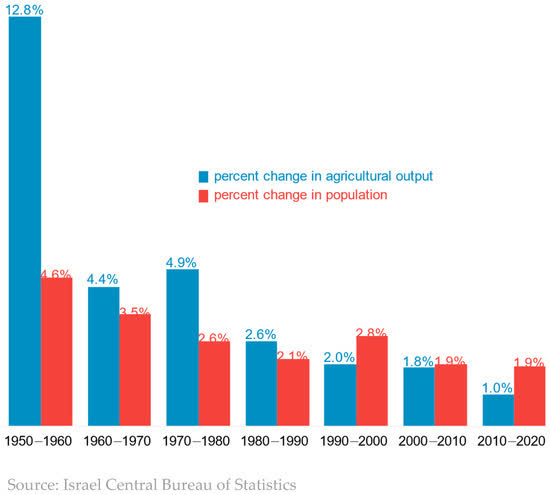

As Israel’s population increases and the country urbanizes, more food must be imported. Israel now imports 50% or more of its agricultural and packaged foods. Climate change with rising temperatures and lower precipitation across the Middle East adds to the need for imported foods. The percentage is going to keep increasing which bodes well for importers.

Ag land to Population Growth (Israel CBS-mdpi)

G. Willi-Food is making capital investments to increase efficiencies and cut costs. The future for investors in G. Willi-Food looks good if peace can prevail. It is a Buy opportunity in the $9 range with lots of upside potential in the event of peace and continuing prosperity the people enjoy.

Source link