Ethereum Open Interest gains by $1B – Impact on ETH?

- While Open Interest increased, Funding Rate stalled.

- The price of the altcoin might keep swinging between $3,400 and $3,600 in the short term.

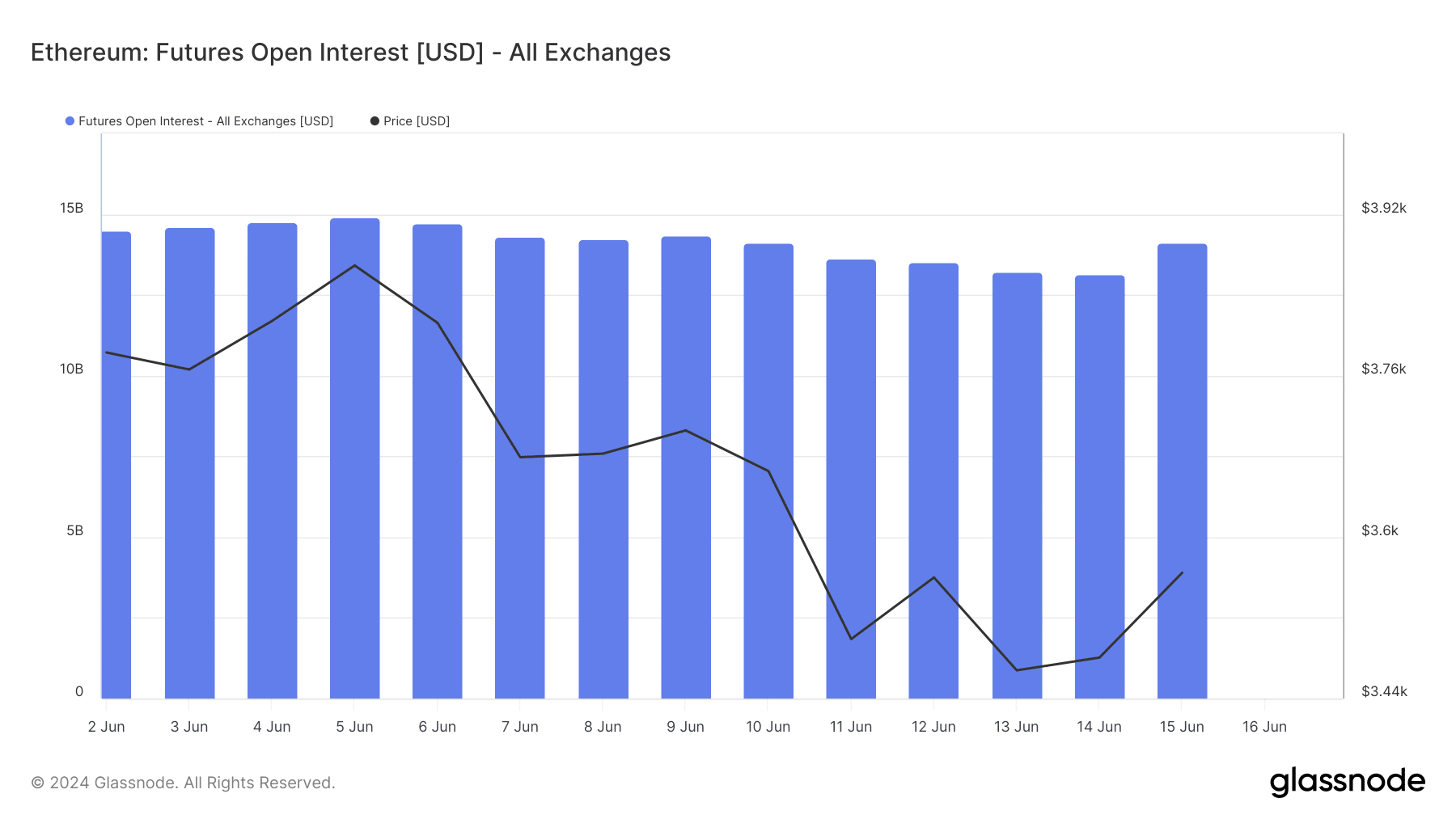

One day after Ethereum’s [ETH] Open Interest dropped to $13.14 billion, it added another billion to its value. At press time, the Open Interest (OI) was $14.10 billion, according to data from Glassnode.

OI is the value of outstanding futures contracts in the market. Whenever it decreases, it means that traders are closing positions related to the cryptocurrency. However, an increase suggests otherwise.

Speculation is a ticket to a new high

Thus, the rise in Ethereum contracts indicates increased speculative activity regarding the altcoin. In many instances, an increase in OI offers strength to the price direction.

For ETH, it might not be different. As of this writing, ETH changed hands at $3,563, representing a slight 1.10% increase within the last hour.

By the look of things, this could be the start of a significant uptrend for the cryptocurrency.

However, the trading volume had decreased by 35.36% in the last 24 hours. The decline in trading volume is a sign that activity involving ETH was lower in the spot market.

If spot market activity continues to drop while trading in the derivatives market increases, ETH’s price might stall around the $3,500 to $3,600 region.

But if buying pressure in the spot market increases, the altcoin might jump in the $3,800 direction.

Skepticism lingers

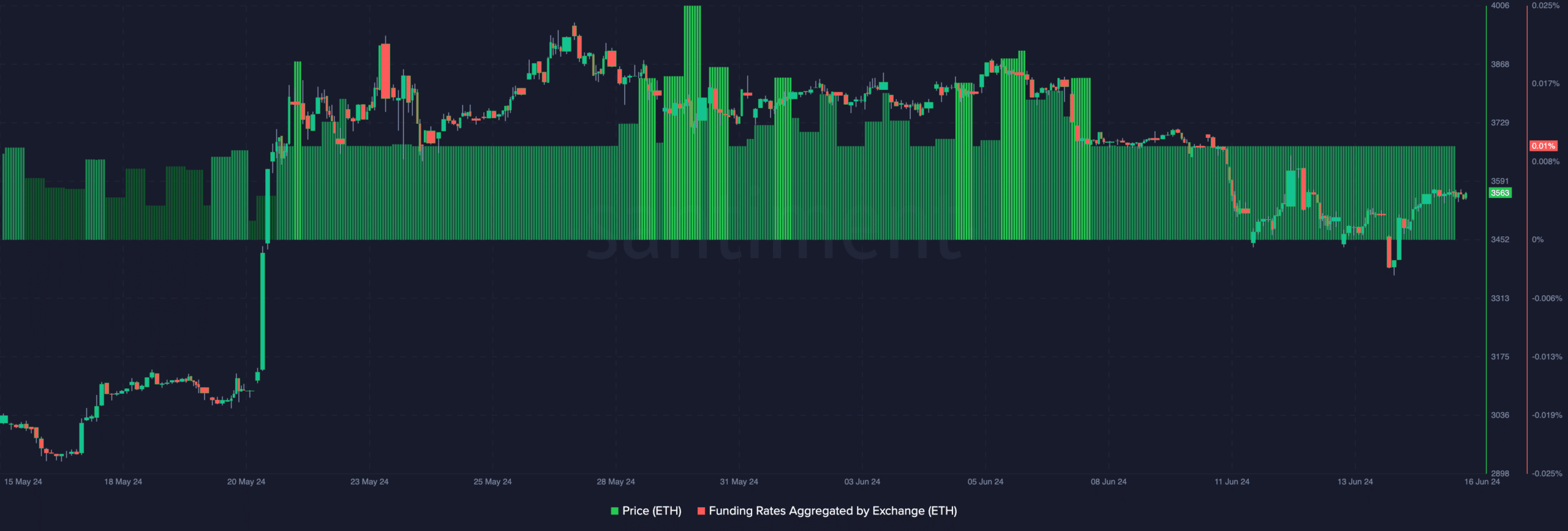

Despite the outlook, Ethereum’s Funding Rate has remained stagnant since the 8th of June. Funding Rate is the cost of holding an open position in the derivatives market.

If funding is positive, it means the contract price is trading at a premium to the spot price. In a situation like this, longs pay short to keep their positions open.

On the other hand, a negative funding implies that shorts are paying longs. Also, the contract value of the cryptocurrency is at a discount.

For ETH, the low Funding Rate and high price means that spot volume might soon begin to pick up.

If this is the case, the reasonable inference could be a bullish move for Ethereum. Nonetheless, the price of the cryptocurrency might fail to hit $4,000 in the coming week.

In addition, AMBCrypto looked at the Taker Sell Ratio. To get this ratio, we need to divide the sell volume by the total perpetual swaps.

When the ratio is lower than 0.5, it means that selling pressure has decreased. However, a value higher than 0.5 indicate the selling is dominant in the market.

Realistic or not, here’s ETH’s market cap in BTC terms

As of this writing, Ethereum’s Taker Sell Ratio was 0.50, according to data from CryptoQuant. If the condition remains the same, ETH’s price might struggle to close in on $4,000 as mentioned earlier.

In the coming week, the value of the cryptocurrency might trade between $3,400 and $3,600 as it did in previous weeks.

Source link