Hiltzik: How the fast-food industry uses deceptive employment numbers

The fast-food industry has been wringing its hands over the devastating impact on its business from California’s new minimum wage law for its workers.

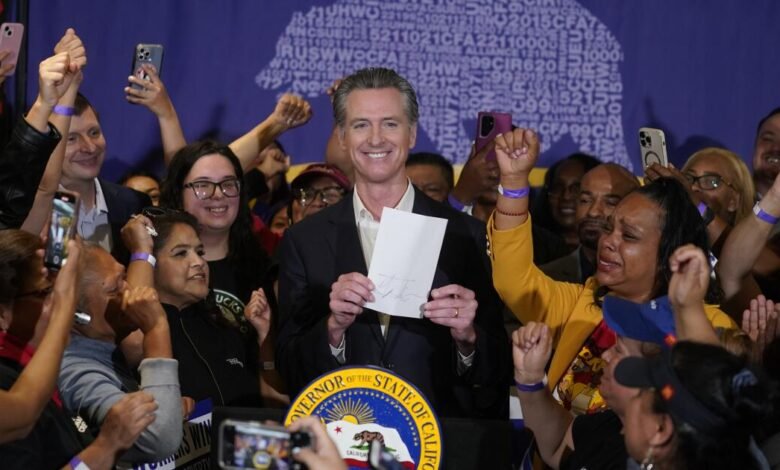

Their raw figures certainly seems to bear that out. A full-page ad recently placed in USA Today by the California Business and Industrial Alliance asserted that nearly 10,000 fast-food jobs had been lost in the state since Gov. Gavin Newsom signed the law in September.

The ad listed a dozen chains, from Pizza Hut to Cinnabon, whose local franchisees had cut employment or raised prices, or are considering taking those steps. According to the ad, the chains were “victims of Newsom’s minimum wage,” which increased the minimum wage in fast food to $20 from $16, starting April 1.

The rapid job cuts, rising prices, and business closures are a direct result of Governor Newsom and this short-sighted legislation

— Business lobbyist Tom Manzo, touting misleading statistics

Here’s something you might want to know about this claim. It’s baloney, sliced thick. In fact, from September through January, the period covered by the ad, fast-food employment in California has gone up, as tracked by the Bureau of Labor Statistics and the Federal Reserve. The claim that it has fallen represents a flagrant misrepresentation of government employment figures.

Something else the ad doesn’t tell you is that after January, fast-food employment continued to rise. As of April, employment in the limited-service restaurant sector that includes fast-food establishments was higher by nearly 7,000 jobs than it was in April 2023, months before Newsom signed the minimum wage bill.

Despite that, the job-loss figure and finger-pointing at the minimum wage law have rocketed around the business press and conservative media, from the Wall Street Journal to the New York Post to the website of the conservative Hoover Institution.

We’ll be taking a closer look at the corporate lobbyist sleight-of-hand that makes job gains look like job losses. But first, a quick trot around the fast-food economic landscape generally.

Few would argue that the restaurant business is easy, whether we’re talking about high-end sit-down dining, kiosks and food trucks, or franchised fast-food chains. The cost of labor is among the many expenses that owners have to deal with, but in recent years far from the worst. That would be inflation in the cost of food.

Newport Beach-based Chipotle Mexican Grill, for example, disclosed in its most recent annual report that food, beverages and packaging cost it $2.9 billion last year, up from $2.6 billion in 2022 — though those costs declined as a share of revenue to 29.5% from 30.1%. Labor costs in 2023 came to $2.4 billion, but fell to 24.7% of revenue from 25.5% in 2022.

At Costa Mesa-based El Pollo Loco, labor and related costs fell last year by $3.5 million, or 2.7%, despite an increase of $4.1 million that the company attributed to higher minimum wages enacted in the past as well as “competitive pressure” — in other words, the necessity of paying more to attract employees in a tight labor market.

Then there’s Rubio’s Coastal Grill. On June 3 the Carlsbad chain confirmed that it had closed 48 of its California restaurants, about one-third of its 134 locations. As my colleague Don Lee reported, Rubio’s attributed the closings to the rising cost of doing business in California.

There’s more to the story, however. The biggest expense Rubio’s has been facing is debt — a burden that has grown since the chain was acquired in 2010 by the private equity firm Mill Road Capital. By 2020, the chain owed $72.3 million, and it filed for bankruptcy. Indeed, in its full declaration with the bankruptcy court filed on June 5, the company acknowledged that along with increases in the minimum wage, it was facing an “unsustainable debt burden.”

The company emerged from bankruptcy at the end of 2020 with settlements that included a reduction in its debt load. Then came the pandemic, a significant headwind. Among its struggles was again its debt — $72.9 million owed to its largest creditor, TREW Capital Management, a firm that specializes in lending to distressed restaurant businesses. It filed for bankruptcy again on June 5, two days after announcing its store closings. The case is pending.

Fast-food and other restaurant jobs slump every year from the fall through January, due to seasonal factors (red line); seasonal adjustments (blue line) give a more accurate picture of employment trends. The sharp decline in 2020 was caused by the pandemic.

(Federal Reserve Bank of St. Louis)

It’s worth noting that high debt is often a feature of private-equity takeovers — in such cases saddling an acquired company with debt gives the acquirers a means to extract cash from their companies, even if it complicates the companies’ path to profitability. Whether that’s a factor in Rubio’s recent difficulties isn’t clear.

That brings us back to the claim that job losses among California’s fast-food restaurants are due to the new minimum wage law.

The assertion appears to have originated with the Wall Street Journal, which reported on March 25 that restaurants across California were cutting jobs in anticipation of the minimum wage increase taking effect on April 1.

The article stated that employment in California’s fast food and “other limited-service eateries was 726,600 in January, “down 1.3% from last September,” when Newsom signed the minimum wage law. That worked out to employment of 736,170 in September, for a purported loss of 9,570 jobs from September through January.

The Journal’s numbers were used as grist by UCLA economics professor Lee E. Ohanian for an article he published on April 24 on the website of the Hoover Institution, where he is a senior fellow.

Ohanian wrote that the pace of the job loss in fast-food was far greater than the overall decline in private employment in California from September through January, “which makes it tempting to conclude that many of those lost fast-food jobs resulted from the higher labor costs employers would need to pay” when the new law kicked in.

CABIA cited Ohanian’s article as the source for its claim in its USA Today ad that “nearly 10,000” fast-food jobs were lost due to the minimum wage law. “The rapid job cuts, rising prices, and business closures are a direct result of Governor Newsom and this short-sighted legislation,” CABIA founder and president Tom Manzo says on the organization’s website.

Here’s the problem with that figure: It’s derived from a government statistic that is not seasonally adjusted. That’s crucial when tracking jobs in seasonal industries, such as restaurants, because their business and consequently employment fluctuate in predictable patterns through the year. For this reason, economists vastly prefer seasonally adjusted figures when plotting out employment trendlines in those industries.

The Wall Street Journal’s figures correspond to non-seasonally adjusted figures for California fast-food employment published by the Bureau of Labor Statistics. (I’m indebted to nonpareil financial blogger Barry Ritholtz and his colleague, the pseudonymous Invictus, for spotlighting this issue.)

Figures for California fast-food restaurants from the Federal Reserve Bank of St. Louis show that on a seasonally adjusted basis employment actually rose in the September-to-January period by 6,335 jobs, from 736,160 to 742,495.

That’s not to say that there haven’t been employment cutbacks this year by some fast-food chains and other companies in hospitality industries. From the vantage point of laid-off workers, the manipulation of statistics by their employers doesn’t ease the pain of losing their jobs.

Still, as Ritholtz and Invictus point out, it’s hornbook economics that the proper way to deal with non-seasonally adjusted figures is to use year-to-year comparisons, which obviate seasonal trends.

Doing so with the California fast-food statistics give us a different picture from the one that CABIA paints. In that business sector, September employment rose from a seasonally adjusted 730,000 in 2022 to 741,079 in 2024. In January, employment rose from 732,738 in 2023 to 742,495 this year.

Restaurant lobbyists can’t pretend that they’re unfamiliar with the concept of seasonality. It’s been a known feature of the business since, like, forever.

The restaurant consultantship Toast even offers tips to restaurant owners on how to manage the phenomenon, noting that “April to September is the busiest season of the year,” largely because that period encompasses Mother’s Day and Father’s Day, “two of the busiest restaurant days of the year,” and because good weather encourages customers to eat out more often.

What’s the slowest period? November to January, “when many people travel for holidays like Thanksgiving or Christmas and spend time cooking and eating with family.”

In other words, the lobbyists, the Journal and their followers all based their expressions of concern on a known pattern in which restaurant employment peaks into September and then slumps through January — every year.

They chose to blame the pattern on the California minimum wage law, which plainly had nothing to do with it. One can’t look into their hearts and souls, but under the circumstances their arguments seem more than a teensy bit cynical.

The author of the Wall Street Journal article, Heather Haddon, didn’t reply to my inquiry about why she appeared to use non-seasonally adjusted figures when the adjusted figures were more appropriate. Tom Manzo, the founder and president of CABIA, didn’t respond to my request for comment.

Ohanian acknowledged by email that “if the data are not seasonally adjusted, then no conclusions can be drawn from those data regarding AB 1228,” the minimum wage law. He said he interpreted the Wall Street Journal’s figures as seasonally adjusted and said he would query the Journal about the issue in anticipation of writing about it later this summer.

He did observe, quite properly, that the labor cost increase from the law was large and that “if franchisees continue to face large food cost increases later this year, then the industry will really struggle.” Fast-food companies already have instituted sizable price increases to cover their higher expenses, he observed. “The question thus becomes how sensitive are fast-food consumers to higher prices,” a topic he says he will be researching as the year goes on.

Source link