Is Nvidia Stock a Buy After the 10-for-1 Stock Split?

Shares in this artificial intelligence titan have become significantly cheaper, but its massive market cap remains the same.

With shares up by an eyewatering 25,000% over the last 10 years, it’s no surprise that Nvidia (NVDA 4.18%) relies on stock splits to keep its equity price manageable for smaller investors who may not have access to fractional shares. The most recent of these went into effect on June 7 and gave investors 10 shares of Nvidia for each one they previously owned — bringing its stock price to around $126 at the time of writing.

The stock split did nothing to change Nvidia’s $3 trillion market cap, which represents the value of all its shares combined. However, some market participants are hopeful that the lower share price could make Nvidia’s equity more liquid and help it maintain its explosive bull run. Let’s dig deeper to decide if this technology giant is still a buy.

What is Nvidia’s bull thesis?

If the generative artificial intelligence (AI) industry can be likened to the California gold rush, Nvidia would be selling the picks and shovels every miner needs to dig for gold. The company’s industry-leading graphics processing units (GPUs) are crucial for running and training complex AI algorithms. And this has led to explosive growth and margins.

Nvidia’s first-quarter revenue increased 262% year over year to $26 billion, driven by sales of data center chips, such as the H100. And net income jumped 628% to $14.88 billion.

Considering this elevated growth rate, Nvidia’s stock is still reasonably valued at a forward price-to-earnings (P/E) ratio of around 47. For comparison, rival chipmaker Advanced Micro Devices has the same forward P/E despite only growing sales by 2% in its first quarter. That said, Nvidia’s stock might not be as cheap as it looks on the surface.

Nvidia is not as cheap as it looks

Over the next few years, Nvidia will face incredibly challenging comps. After enjoying booming sales over the previous 12 months, it will be difficult for the company to continue growing its revenue relative to extremely high prior-year numbers. And this might be a big reason why the stock’s forward valuation is so low relative to growth.

Demand could become another problem. While Nvidia’s picks-and-shovels take on the AI industry protects it from competition on the consumer side of the industry, it wouldn’t be shielded from an industrywide slowdown, which could occur if its clients aren’t able to generate enough cash flow to justify their spending on Nvidia chips.

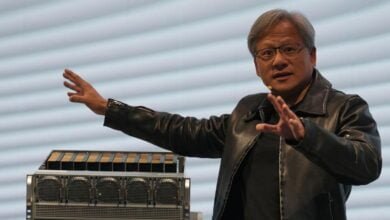

Image source: Getty Images.

The long-term prospects of AI look undeniably bright. But there could be many ups and downs before it reaches its full potential — just like other major technologies like the internet, electric vehicles, or even blockchain.

Buy with caution

For many retail investors, Nvidia’s stock split will be a powerful psychological encouragement to buy the stock. At just $120 per share, the mammoth company now looks relatively small. And those who were previously intimidated by its four-digit stock price may now be encouraged to finally pull the trigger and hit the buy button.

But while Nvidia certainly has a bright future as the AI industry develops, investors who buy the stock now are late to the party. And this brings the risk of being left holding the bag if things go wrong.

Over the next few years, Nvidia will face more difficult comps, which could cause top- and bottom-line growth to slow down, even if the AI industry remains strong. While shares still look capable of outperforming over the long term, investors should remain aware of the significant risks they are taking by buying a company that has already risen so far so fast.

Historically, no stock has grown exponentially forever. And Nvidia will likely face a correction at some point. Be careful out there.

Will Ebiefung has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices and Nvidia. The Motley Fool has a disclosure policy.

Source link